does doordash report income to irs

You just have to fill out a W-4 form if you are self-employed and report that part of your earnings. Youll be responsible for paying both income taxes and self-employment tax.

Prepare For Tax Season With These Restaurant Tax Tips

1099-NEC forms are federal income tax information forms used to report earnings and proceeds other than wages salaries and tips which are reported on the federal W-2 form.

. Dasher 6 months On my average day in my town on the outskirts of a big city I pick up from the same 5-6 restaurants over and over. Gross receipts or sales. Does DoorDash Report to the IRS.

DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. DoorDash can be used as proof of income. Does DoorDash provide a 1099.

March 31 -- E-File 1099-K forms with the IRS via FIRE. The forms are filed with the US. Internal Revenue Service IRS and if.

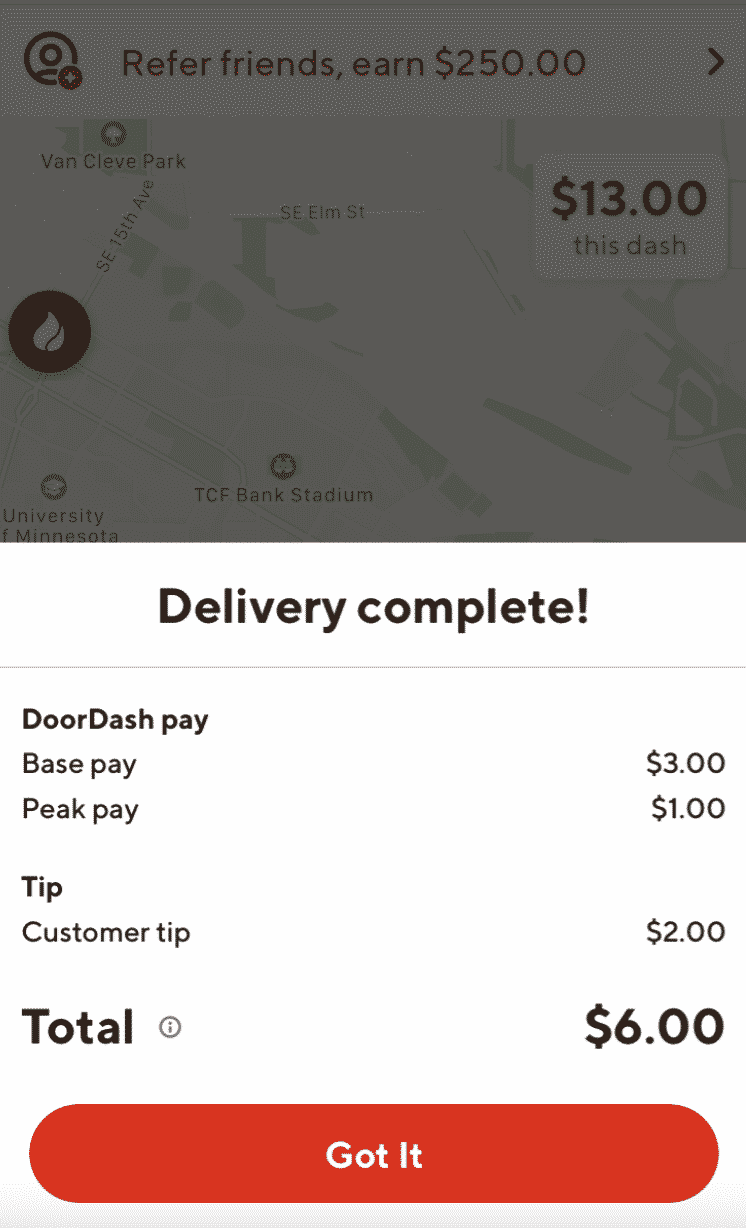

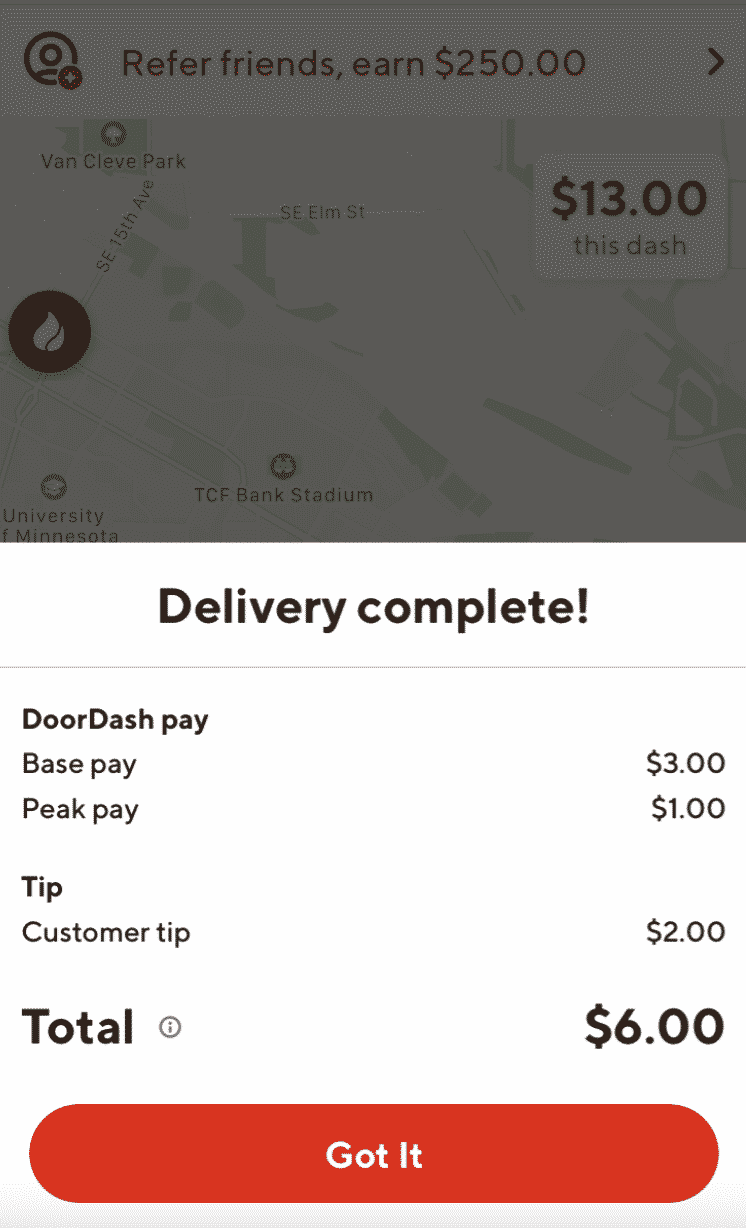

You are required to report and pay taxes on any income you receive. Today I was picking up from Carls Jr that has a Pizza Hut in the same parking lot. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

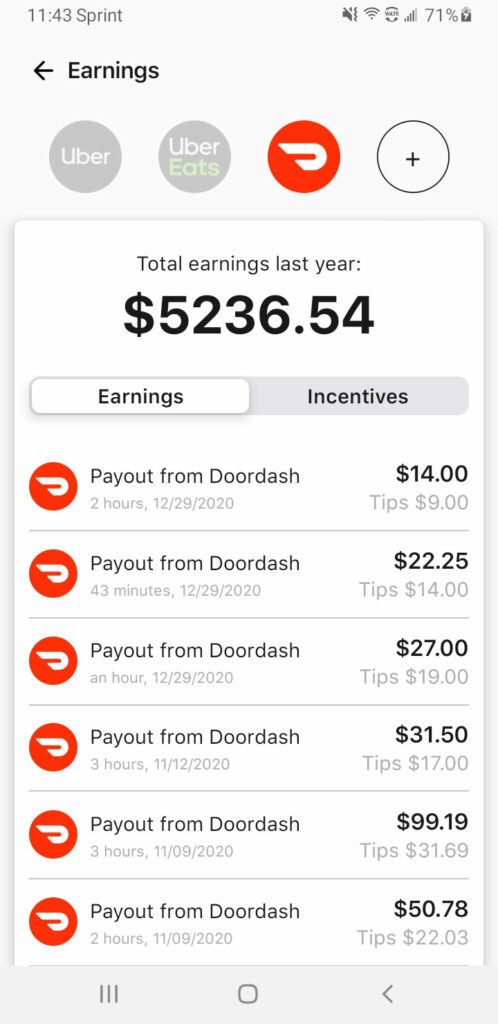

Some confuse this with meaning they dont need to report that income on their taxes. In order to convey the original authors tone you also need to provide the context. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

I gave the worker from Pizza Hut a ride home today. As a Dasher youre an independent contractor. That said this depends on the state.

In this way Does DoorDash count as job. According to the IRS independent contractors need to report and file their own taxes. While I was leaving I seen the dude from Pizza Hut who always helps me.

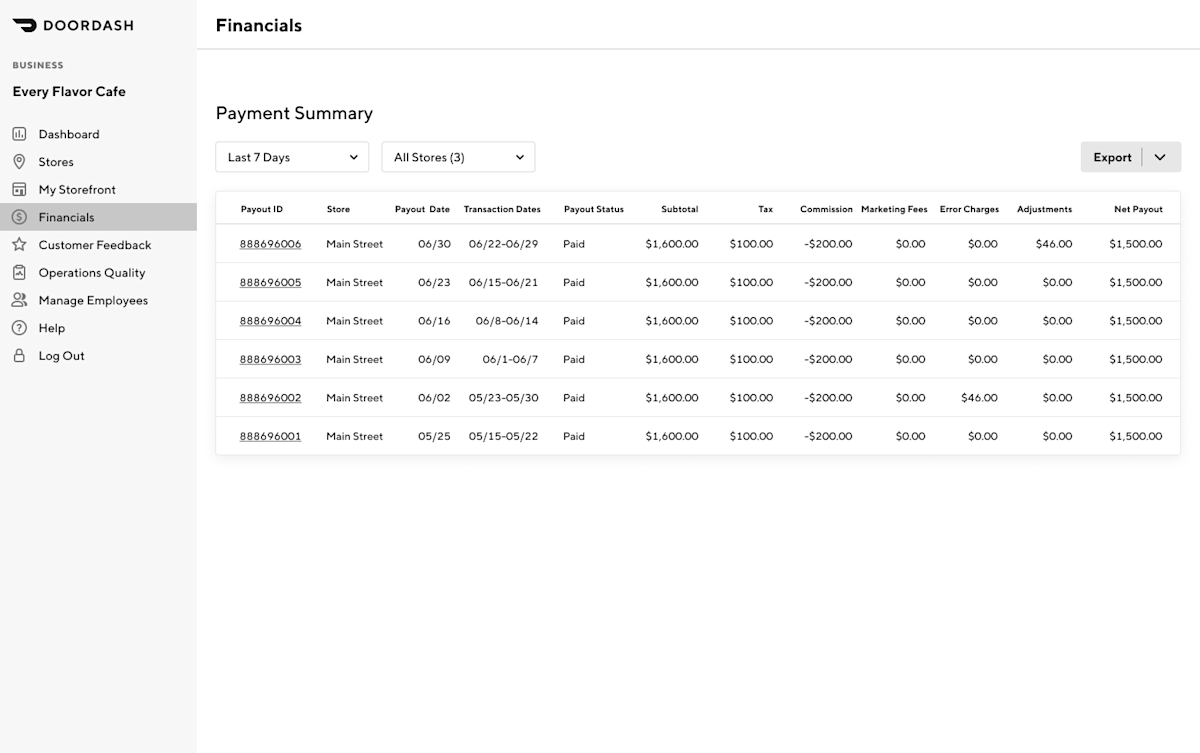

How does Instacart report wages. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. At the end of every quarter add up your income for the quarter and pay at least 25 of that online to the govt.

The 600 threshold is not related to whether you have to pay taxes. Its only that Doordash isnt required to send you a 1099 form if you made less than 600. DoorDash will send you a 1099 form at tax time so that you can report your earnings to the IRS.

How Do I Apply For Unemployment Benefits With DoorDash. Since dashers are treated as business. DoorDash does not take out withholding tax for you.

Doordash does not provide drivers with a report of total earnings tips raises or bonuses. But if filing electronically the deadline is March 31st. It might be a side job or a side hustle but in the end it just means.

You will be required to bring your fully charged smartphone your drivers license. Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. You do not get quarterly earnings reports from dd.

Stripe also sends 1099-Ks for other companies or payments but the way theyre set up with DoorDash means DoorDash work will go on a 1099-NEC for DoorDash. How does DoorDash report to IRS. DoorDash uses Stripe to process their payments and tax returns.

DoorDash typically manages 1099 delivery drivers. If you overpaid at the end of the year you will get some money back. The forms are filed with the US.

You should report your income immediately if they do not send you a 1099. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. Once you receive the 1099 form and file the taxes you need to report the exact figure as the overall income to the IRS.

Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. January 31 -- Send 1099 form to recipients. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

Doordash considers delivery drivers to be independent contractors. If you delivered for multiple delivery platforms and received multiple 1099 forms you add all that money up and enter the total income on Line 1. January 31 -- Send 1099 form to recipients.

Typically you will receive your 1099 form before January 31 2022. Does DoorDash issue a 1099. Since you have dropped the income source many states in The United states involve working part-time and gathering jobless benefits.

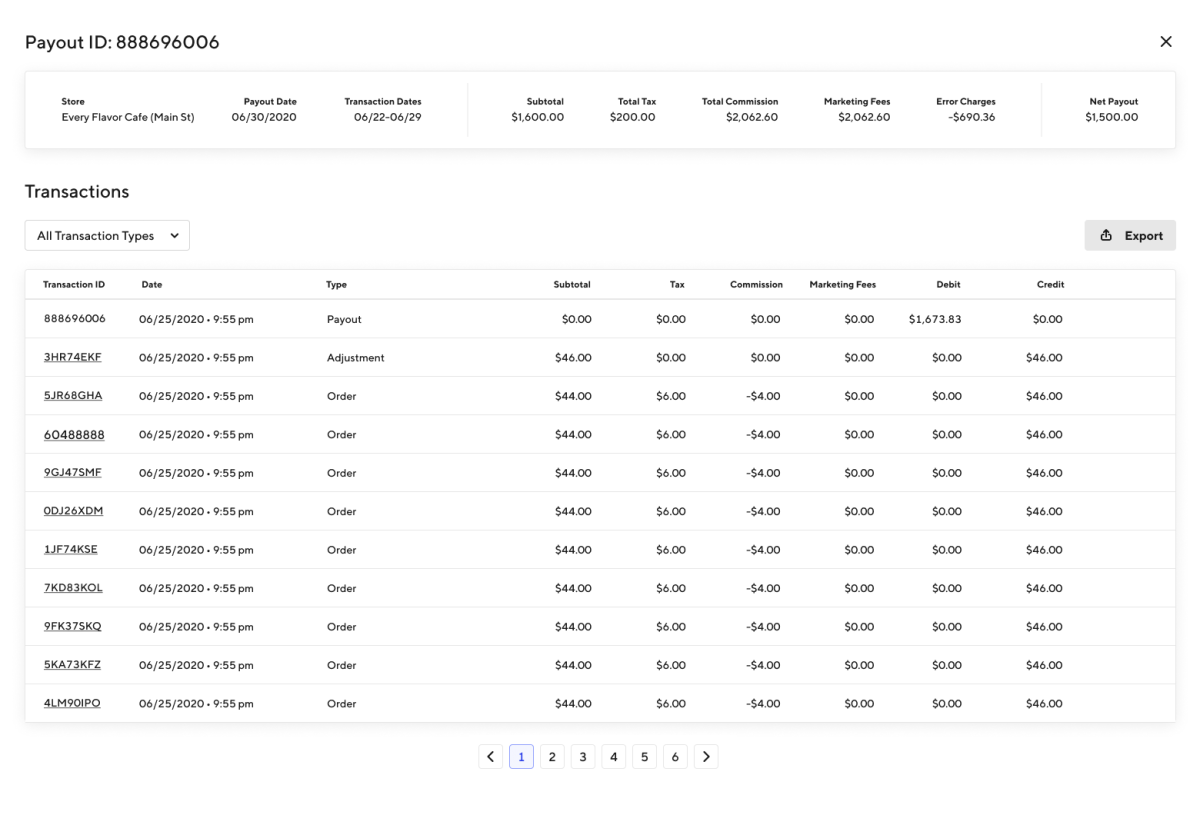

DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. You do have the. If your store is on Marketplace Facilitator DoorDash.

You do not have to report your door dash earnings in the unemployment office. Here you will add up how much money you received for your delivery work. It sends it out regularly to them but anyone who hasnt yet received it can request it.

Doordash will send you a 1099-NEC form to report income you made working with the company. February 28 -- Mail 1099-K forms to the IRS. This is where you enter your earnings from Grubhub Doordash Uber Eats and others.

You will not be compensated for working for DoorDash.

Doordash Data Breach 5 Things To Do If You Were Affected

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Critical Doordash Tax Information For 2022

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash 1099 Critical Doordash Tax Information For 2022

Prepare For Tax Season With These Restaurant Tax Tips

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Critical Doordash Tax Information For 2022

How To Do Taxes For Doordash Drivers 2020 Youtube

Doordash Taxes Does Doordash Take Out Taxes How They Work

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Does Doordash Pay For Gas Financial Panther

Prepare For Tax Season With These Restaurant Tax Tips